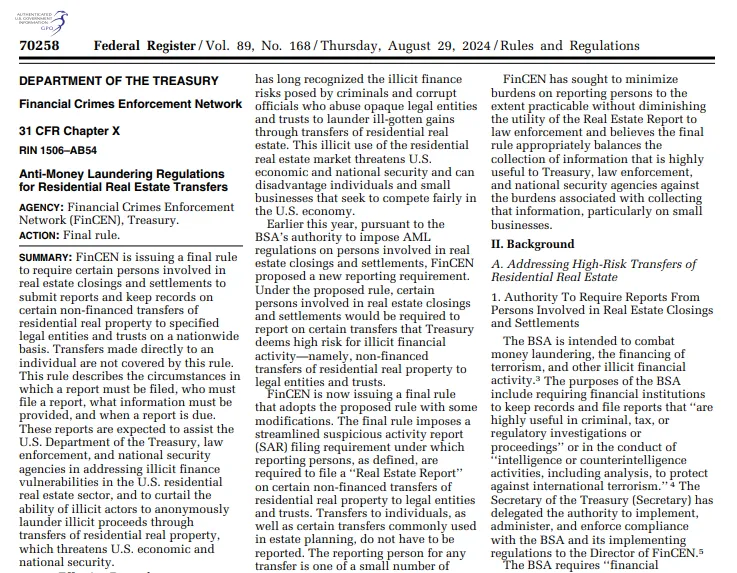

The regulatory landscape for Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) compliance is rapidly evolving, with recent enforcement actions against major U.S. banks highlighting critical areas of risk and opportunity for improvement. As financial institutions face increasing complexity from digital assets, innovation, and shifting regulatory priorities, understanding the latest trends in enforcement and best practices is essential for compliance professionals. This article distills the most important insights from the 2025 AML & Fraud School presentation, focusing on the current regulatory environment, recent enforcement actions, common themes, and actionable considerations for your BSA/AML program.

NETBankAudit experts have over 25 years of experience in BSA/AML audits and compliance. If you have any questions after reading this guide, please reach out to our team.

The Current Regulatory Environment: Deregulation and Innovation

Shifting Priorities and Regulatory Pauses

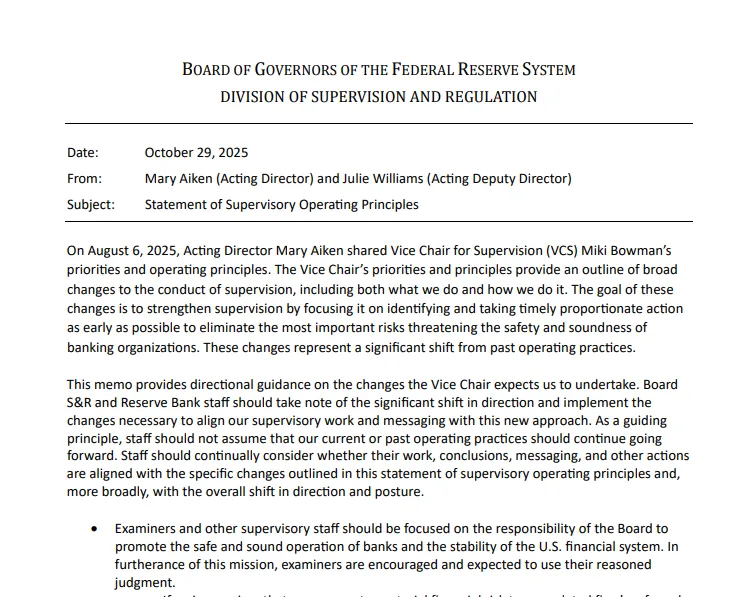

The AML regulatory environment in 2025 is marked by a notable shift toward deregulation and a focus on innovation. Several key developments are shaping the landscape:

- The AML Act is currently paused, creating uncertainty around future requirements.

- Enforcement of the Corporate Transparency Act’s Beneficial Ownership Information (BOI) requirements for domestic entities has been suspended.

- There have been no updates on FinCEN’s eight exam and supervisory priorities, leaving institutions to interpret risk independently.

- AML rules for investment advisors have been postponed, further delaying clarity for certain sectors.

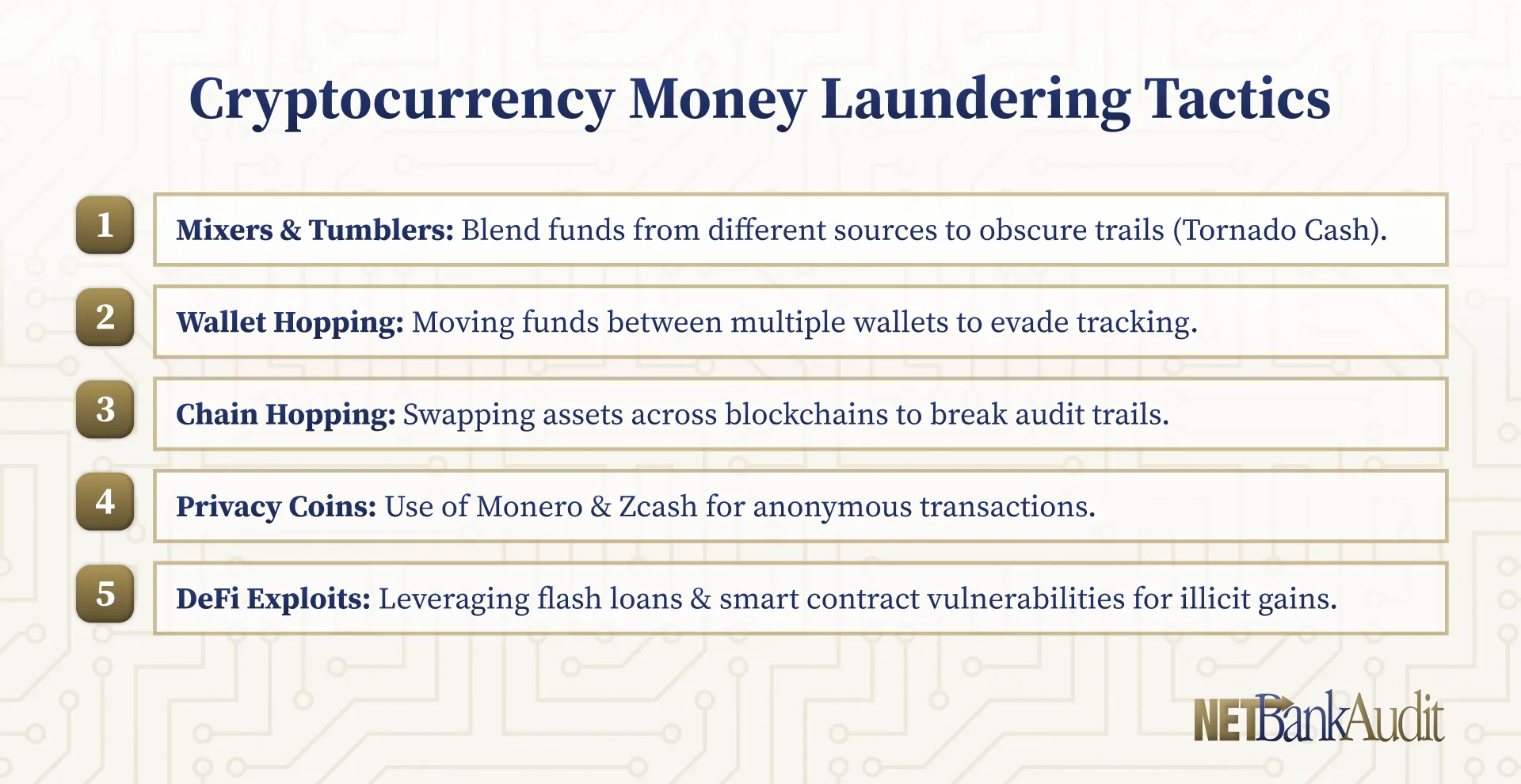

At the same time, regulators are emphasizing innovation, particularly in the areas of cryptocurrency, digital assets, and artificial intelligence. The Treasury’s request for comment on innovative methods to detect illicit activity involving digital assets signals a growing interest in leveraging technology to combat financial crime.

Enforcement Trends: Fewer Actions, But Higher Stakes

While the number of BSA enforcement actions by federal banking agencies has decreased, the actions that do occur are more significant in scope and consequence. In 2025, enforcement activity has included high-profile cases involving Bank of America, TD Bank, and Wells Fargo, each with unique lessons for the industry.

Recent BSA/AML Enforcement Actions: What Happened and Why

Major Cases in 2025: Bank of America, TD Bank, and Wells Fargo

Recent enforcement actions have targeted some of the largest and most systemically important banks in the United States. These cases provide a window into regulatory expectations and common pitfalls.

- TD Bank, N.A. and TD Bank USA: Subject to a cease and desist order, TD Bank faced $1.75 billion in civil money penalties and growth restrictions. The bank was cited for willfully failing to establish an adequate BSA compliance program, prioritizing growth over controls, and failing to detect and report suspicious activity—including insider involvement in laundering narcotics proceeds.

- Wells Fargo, N.A.: Entered into a formal agreement with the OCC, with no civil money penalties but significant restrictions on new products and services. Deficiencies included failures in suspicious activity and currency transaction reporting, customer due diligence, and beneficial ownership programs.

- Bank of America, N.A.: Received a cease and desist/consent order, requiring a third-party assessment of its BSA and sanctions compliance programs, transaction monitoring look-backs, and staffing assessments. The bank was cited for unsafe or unsound practices in sanctions compliance, transaction monitoring, governance, and training.

Key Enforcement Action Details

The enforcement actions against these institutions were not limited to monetary penalties. They included a range of corrective measures, such as:

- Appointment of compliance committees with independent directors

- Third-party reviews and monitorships of BSA/AML programs

- Restrictions on growth and new business initiatives until remediation is complete

- Comprehensive look-backs on suspicious activity reporting and transaction monitoring

- Enhanced training and staffing requirements

These measures underscore the importance of proactive risk management and continuous improvement in BSA/AML programs.

Common Themes in BSA/AML Enforcement Actions

Recurring Deficiencies Across Institutions

A review of recent enforcement actions reveals several recurring themes that should be top of mind for compliance professionals. These issues often span all pillars of a bank’s BSA/AML compliance program and can have far-reaching consequences if left unaddressed.

- Customer Due Diligence (CDD) Deficiencies: Many institutions failed to collect, document, and utilize CDD information effectively, particularly in suspicious activity investigations. In some cases, CDD was not referenced at all during alert investigations.

- Resource Constraints: Insufficient resources—both personnel and technology—were a common factor in program failures. Banks often lacked the staffing and expertise needed to manage high-risk operations and keep up with alert backlogs.

- Missed Suspicious Activity Reports (SARs): Delays and failures in filing SARs, especially related to insider activity and high-risk transactions, were frequently cited. Some banks only began filing SARs after law enforcement inquiries.

- Gaps in Transaction Monitoring: Inadequate coverage of transaction types, such as checks or peer-to-peer payments, led to missed suspicious activity. Transaction monitoring systems were often not effectively tested or validated.

- Data Quality and Integrity Issues: Poor data governance and lack of data lineage documentation hindered the effectiveness of BSA/AML technology and reporting.

- Insufficient Training: Both front-line and compliance staff often lacked adequate, ongoing training tailored to their roles.

- Oversight and Accountability: Weak governance structures, unclear reporting lines, and lack of board engagement contributed to program breakdowns.

- Back to Basics: Some enforcement actions cited fundamental program issues, indicating a need to revisit the core requirements of BSA/AML compliance.

Considerations for Your BSA/AML Program: Proactive Steps to Avoid Enforcement

Critical Questions for Compliance Leaders

Given the lessons from recent enforcement actions, financial institutions should conduct a thorough self-assessment of their BSA/AML programs. Consider the following questions to identify potential gaps and areas for improvement:

- How does your program compare to the findings in recent consent orders?

- Are changes needed to your BSA compliance program based on recent enforcement trends?

- Do enforcement action issues impact your future priorities or resource allocation?

- Is accountability clearly defined in your organizational structure?

- Does your BSA officer have sufficient authority, independence, and resources?

- Are board members and staff adequately trained and informed about BSA/AML risks?

- How frequently do you review and update transaction monitoring and sanctions screening parameters?

- Is customer due diligence information integrated into your suspicious activity investigations?

- Are there transaction types or business lines not captured by your monitoring systems, and how are these gaps addressed?

- Do you view customers holistically for suspicious activity monitoring?

- How do you ensure data integrity and accurate lineage between systems used for BSA/AML and sanctions compliance?

Enhancing Your Program: Practical Steps

Institutions that want to stay ahead of regulatory expectations should focus on several key areas:

- Strengthen Governance and Oversight: Ensure the board and senior management are actively engaged in BSA/AML oversight, with clear metrics and risk tolerances.

- Invest in Technology and Staffing: Allocate sufficient resources to transaction monitoring, alert investigations, and ongoing training.

- Enhance Data Governance: Develop comprehensive data inventories, establish clear roles for data management, and document data lineage for all key systems.

- Integrate CDD into Investigations: Use customer due diligence information as a core component of suspicious activity monitoring and reporting.

- Conduct Regular Independent Testing: Schedule periodic reviews of your BSA/AML and sanctions compliance programs, including transaction monitoring validation and look-backs.

- Foster a Culture of Compliance: Promote accountability at all levels, from the BSA officer to front-line staff, and ensure performance evaluations reflect BSA responsibilities.

Helpful Resources for BSA/AML Compliance Professionals

Where to Find Guidance and Updates

Staying informed about regulatory changes and enforcement trends is crucial. The following resources provide valuable information for compliance professionals:

- FFIEC

- OCC

- FDIC

- Federal Reserve

- FinCEN TD Bank Consent Order

- OCC Enforcement Action 2024-56

- OCC Enforcement Action 2024-72

- OCC News Release 2025-3

Partner with NETBankAudit for BSA/AML Program Excellence

Navigating the evolving BSA/AML regulatory landscape requires expertise, vigilance, and a proactive approach. NETBankAudit offers specialized BSA/AML audit and advisory services designed to help financial institutions align with regulatory expectations, remediate deficiencies, and build resilient compliance programs. Our team brings decades of regulatory and industry experience, deep subject matter expertise, and a commitment to practical, actionable solutions.

Whether you need an independent review, program enhancement, or ongoing advisory support, NETBankAudit can help you stay ahead of enforcement trends and protect your institution from risk. Contact us today to learn how our tailored services can support your compliance goals and drive lasting value for your organization.

%201%20(1).svg)

%201.svg)

.avif)

.svg)

.webp)

.webp)

.webp)

.png)

.webp)

.webp)

.webp)

.webp)

%201.webp)

.webp)

%20(3).webp)

.webp)

%20Works.webp)

.webp)

.webp)

%20(1).webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

%201.svg)